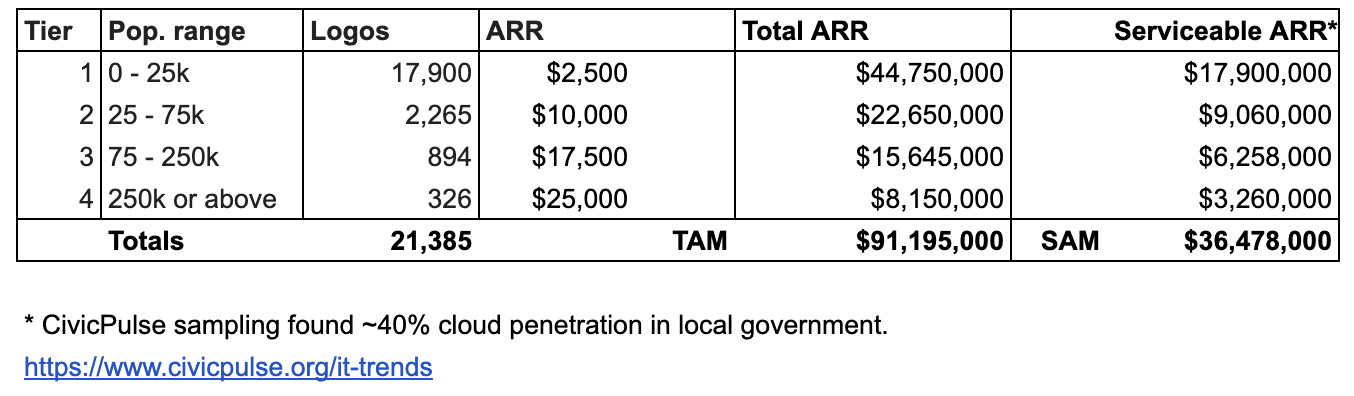

Market Sizing

Government technology is more difficult to size than other industries.

- There 20k+ local governments, each with different purchasing rules — and different financial reporting mechanisms, making national analysis very cumbersome (or impossible). For instance, in some jurisdictions “economic development” is called “community development” or there isn’t even a department; it is just handled by some people or someone in the city manager’s office.

- Big cities have big budgets, but small numbers. Although it may be easier to look at big city purchasing trends (which are more accessible) to determine TAM, that would skew towards bigger cities that have disproportionately long sales cycles and atypical contracts. The reality of local government is that most cities are small (>12k), which compounds the top-down TAM calculus.

- Many new technologies are just that, new. Thus, looking at previous budget allocations for technology misses the point: government spending is only growing so consider willingness to pay (WTP) for bottom-up analysis.

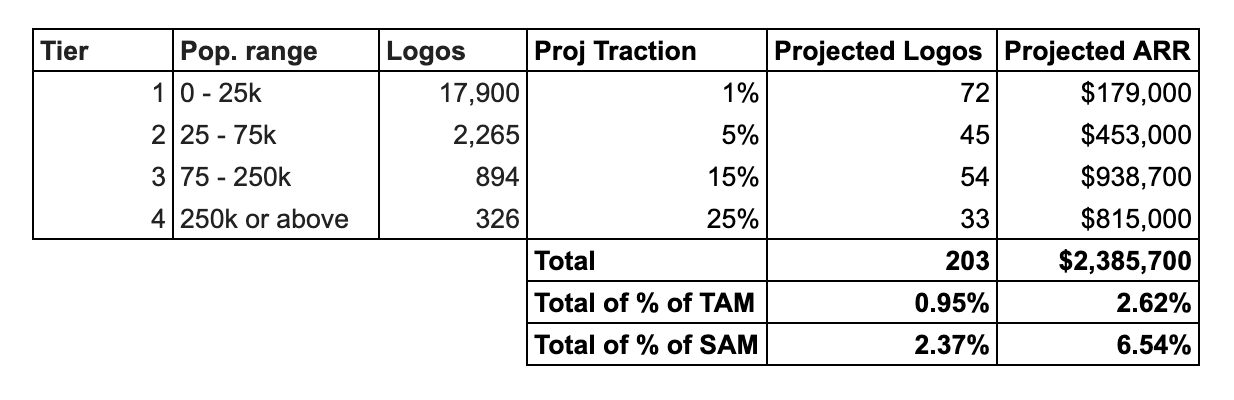

So one should generate a market size using a bottom-up approach, recognizing the differences in city size in both pricing and priority.

We can use a basic population based-breakdown, and in general, cities have a threshold of around $20-25k. Let’s use conservative numbers starting at $18k and working down. We can then easily rough out a TAM of about $91M (per annum).

To generate servicable market – SAM – we can the findings from the report I recently commissioned on GovTech with a leading — and only really — polling firm for local government leaders, where we found about 40% cloud / SaaS adoption.

That is to say, given any city, we have a 40% chance they use some SaaS product. This becomes a handy limiter to apply to the total market. SAM is approximated at ~$36.5M in this example.

City Analysis

Tier 1 cities are very numerous, but so numerous that a hunter strategy would be inefficient; thus, that would be a self-service approach, which has had some but limited success in GovTech. (tl;dr: Traditional web-based marketing approaches, e.g. SEO, don’t apply to this highly-regulated “new” industry. For example, no government employee is likely searching for “department efficiency software”…)

I have found that tiers 2 & 3 are both accessible and reasonably similar to other SMBs: there aren’t dozens of loops to jump through, just usually a POC and a contractor officer (sometimes a committee meeting).

Using rough percetanges for adoption and the previously calculated SAM in each semgment, we can make revenue projections:

If you’re interested in learning more, get in touch: @abhinemani