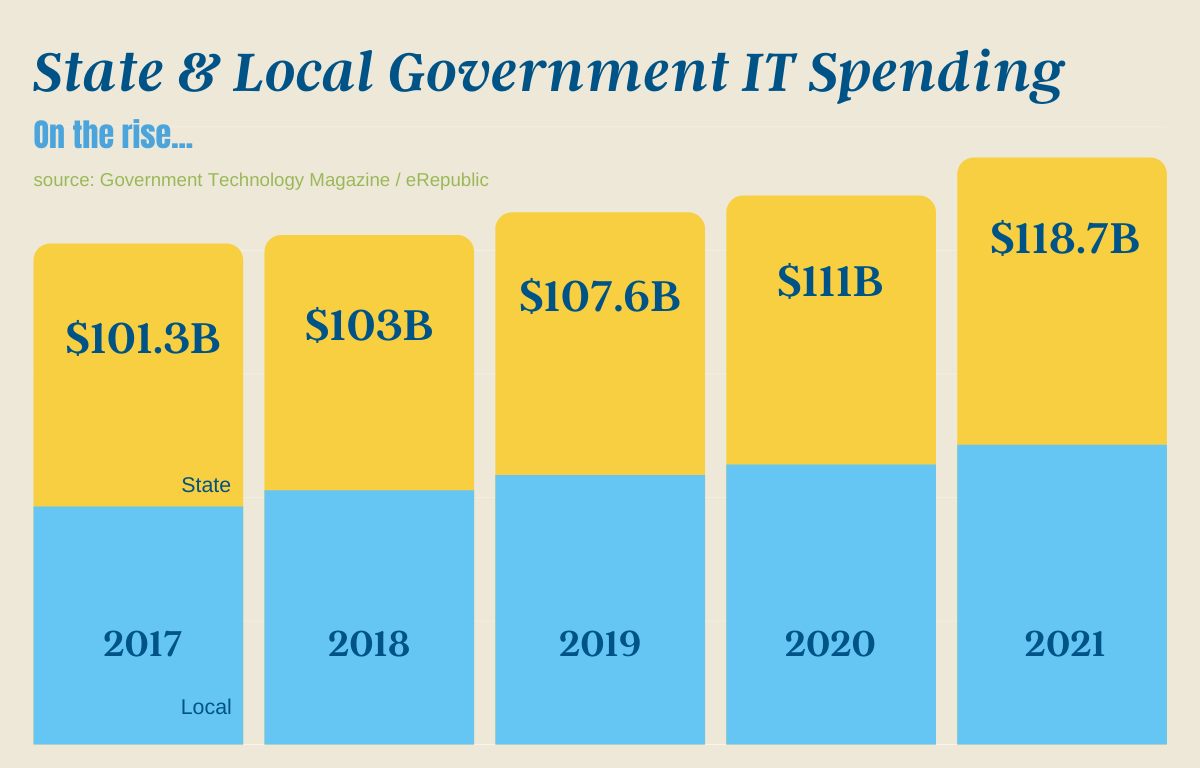

Based on dozens of interviews with CIOs, CTOs, and other departmental heads, along with a unprecedented survey of 400+ local government decision makers, three trends have been fundamentally changing the buyer landscape in government technology over the last ten years, which are now coming to a head: new leadership, personnel turnover, and SaaS expectations. And indeed the pandemic accelerated those drivers. Together, these demand-side shifts not only promise continued growth for the industry, but also more activity, innovation, and competition in the marketplace.

A New Brand of IT Manager

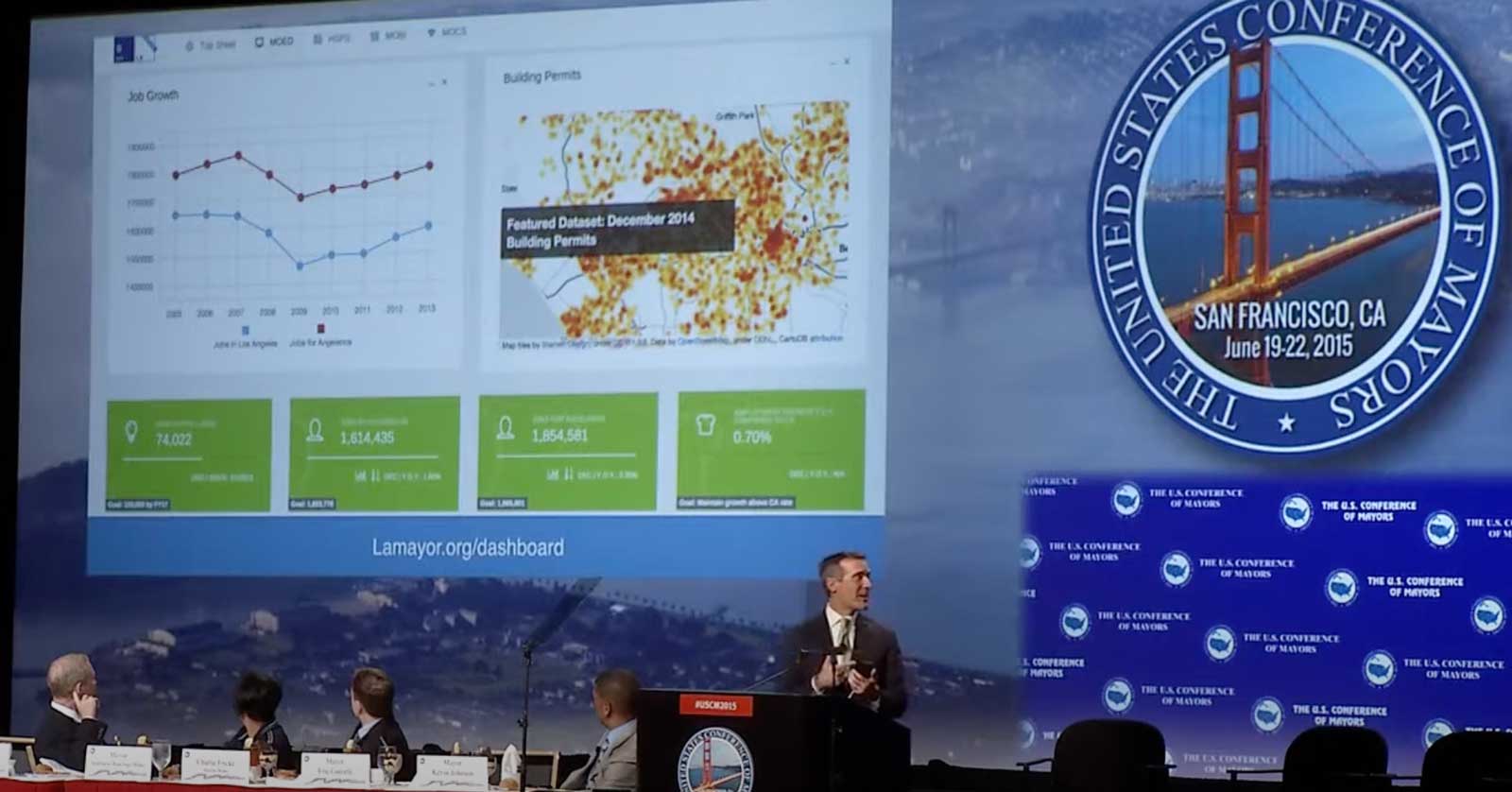

Historically, the IT department was considered a secondary administrative function. In cities, that meant an IT group (a manager and a few analysts/engineers) would report into an Operations Director, then a General Manager, and finally a city manager, or city council. As the role of technology has elevated throughout society, the same has happened structurally within government. After the White House in 2009 by appointing the first Chief Technology Officer and Chief Information Officer, states and cities — that could — followed suit. Various senior technology roles — CIO, CTO, Chief Innovation Officer, Chief Digital Officer, etc — now exist in over 40 of the 50 of the largest cities, and in every single state.

Along with those roles came the elevation of the IT departments to “cabinet-level” meaning that at the very least technology was more publicly visible as a priority for the government. Also, it promises to enable smarter and broader use of technology as the interdepartmental connections grow deeper — and the operational leaders (e.g. GM of Buildings) better understand technology themselves.

These reinforcing trends — new IT roles, elevated departments, and technical operational leadership — should open up the previously entrenched, legacy-dominated government technology market to new players on the outside, just like on the inside.

Empty Seats, Open Opportunities

Strong leaders cultivate strong teams, but government CIOs have had a tough time, especially at the local level. Indeed, hiring technology talent is difficult for even the most financially generous tech companies. The last few decades have seen a “hollowing out” of government technical talent, with budget crises and political conflicts leading to IT departments sometimes with more job openings than current employees. (Furloughs and early retirements enable agencies to reduce spend but maintain opportunity.) Thus, governments struggle to staff against the systems they are required to maintain. (In part because COBOL engineers are just as hard to recruit as data scientists maybe harder.)

During 2020 through early 2021, the pandemic exacerbated this challenge. These empty seats strain the whole organization, making innovation more difficult. CIOs must keep the lights on, not change the wiring. Indeed, many entrepreneurs reported that contracts slowed in 2021 because their government contacts had turned over or were furloughed.

But based on interviews with 20+ government C-level leaders, governments are looking to turnkey SaaS platforms to enable a reorientation of their IT shops. Having had experience with SaaS tools — more below — many CIOs see the opportunity to hire generalists, both technical or not, in “digital service” teams that focus less on custom code and more on the user experience, leveraging a host of vendors to get the job done. Currently, the White House, some states, and many large U.S. cities have a digital service or innovation team, and more are surely on the way in 2022. As modern, digital professionals fill the empty seats in government IT, they will be looking for modern, digital partners in the private sector.

Accordingly as IT departments evolve — effectively turning over — the software systems they had been support will need to change as well, a rare chance for churn in a typically stagnant buyer marketplace.

New SaaS Expectations: Fast, Simple & Modern

The fear coming into the pandemic within local government was profound. Local governments live off their businesses, and are responsible for the majority of public health: the nightmare scenario of no revenue and unprecedented expense. The reality, fortunately, was not so bleak — in fact, most report the budget surpluses through the pandemic. And the federal and state recovery dollars continue to flow (unevenly, however) into local coffers.

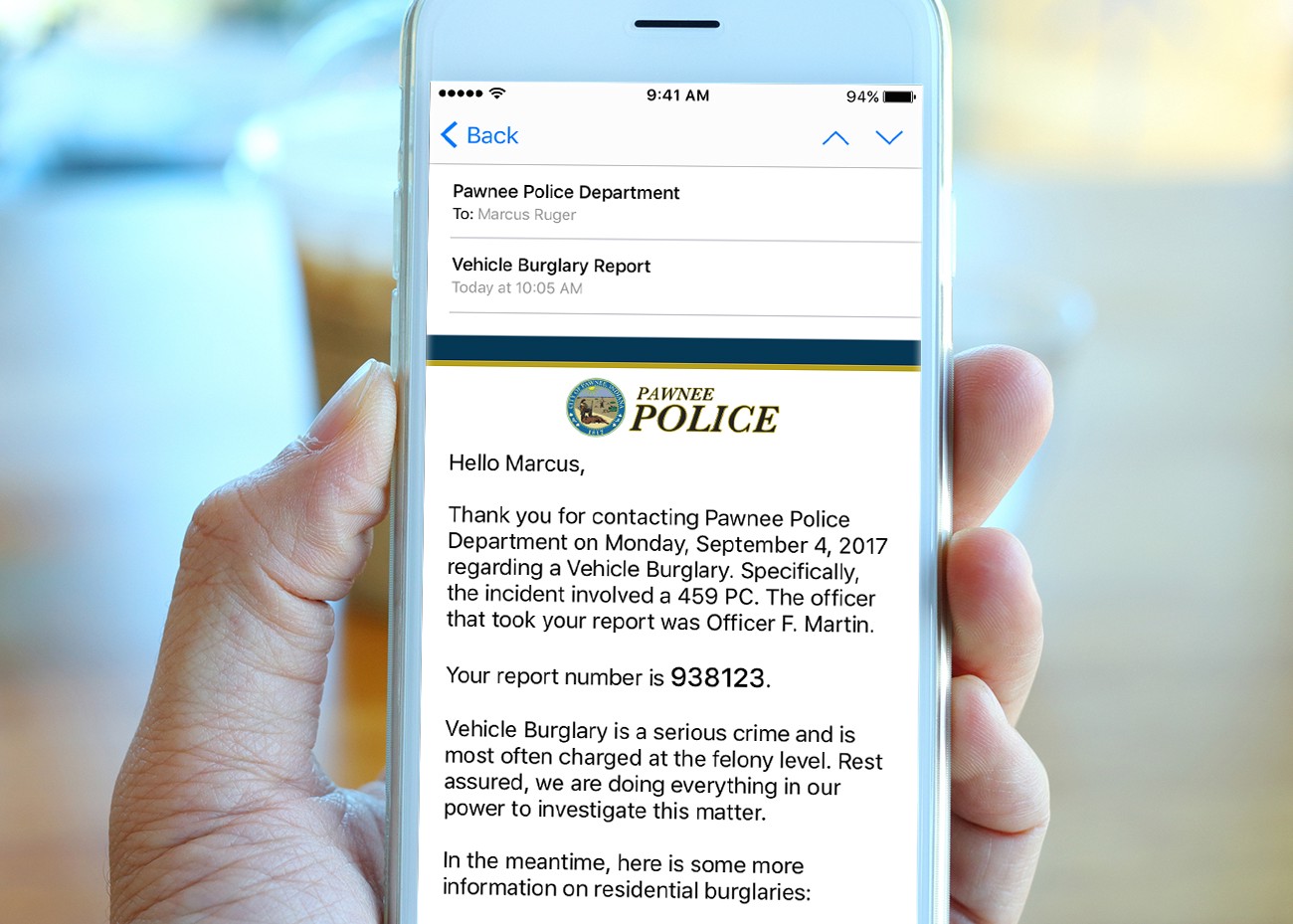

That said, this budgetary windfall should not be seen as a free lunch for software vendors. Over the three dozen local government leaders engaged, none specified that recovery funds were being allocated for IT “capital projects,” which is how IT has historically been procured. Many governments did, however, find money during the first two years of the pandemic for rapid deployments, which is where SaaS tools found traction. Across the board, governments were forced to adopt and support new digital tools — primarily productivity tools for remote work — and many even rapidly integrated quick deploy SaaS solutions to enhance the digital experience for engagement with residents.

As government technology moves from admin-facing to public-facing, the expectations change, and so CIOs have begun to expect private-sector grade digital experiences from their technology vendors. But because many legacy vendors have not been able to modernize their citizen/customer experiences, governments have begun to look at new solutions, including many SaaS solutions “layering” atop the legacy solutions. On the other hand, some have turned to the private sector: A few even reported more substantial, yet rapid deployments of ZenDesk.

The combination of limited funding for capital projects and the heightened expectations for digital should persist and intensify moving forward, opening the door for innovation or disruption.

This briefing is based off of interviews and research from over 20 government officials, a handful of universities and research centers, and a number of GovTech entrepreneurs, conducted in Fall 2021.